In today’s remote work environment, ensuring smooth transactions is essential for businesses and their teams. Choosing the right platform can make all the difference in efficiency and security.

Leading systems like PayPal, Wise, and Payoneer offer reliable options for seamless transfers. These platforms reduce delays and simplify the process, making them ideal for remote collaborations.

At Armasourcing, we understand the complexities of managing transactions across borders. Our solutions are designed to support businesses in paying their teams securely and on time.

Whether you’re handling recurring tasks or one-time projects, the right system ensures trust and efficiency. Let’s explore the best options to meet your needs.

Understanding Payment Methods for Virtual Assistants

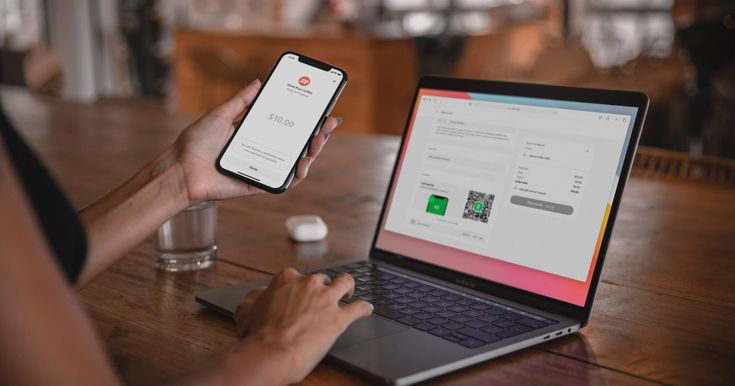

Digital platforms have transformed how businesses handle transactions with remote professionals. These systems ensure smooth operations, especially when working with virtual assistants. By choosing the right tools, businesses can enhance efficiency and build trust.

Defining Payment Platforms and Their Importance

A payment platform is a system that facilitates financial transactions between parties. For businesses, these tools are essential when paying virtual assistants. They offer security, speed, and transparency, making them indispensable in remote work settings.

Platforms like PayPal and Wise have become popular due to their reliability. They simplify the process of transferring money across borders. This ensures that assistants receive their earnings on time, fostering a positive working relationship.

The Role of Digital Transactions in Remote Work

Digital transactions have evolved to meet the needs of modern businesses. They eliminate delays and reduce errors, which is crucial for remote teams. This evolution has made it easier for companies to manage their finances efficiently.

At Armasourcing, we integrate these solutions to support businesses. Our focus is on providing secure and efficient systems that meet the demands of remote work. By leveraging platforms like Payoneer, we ensure seamless transactions for our clients.

Understanding these methods is key to successful collaborations. It allows businesses to choose the right tools for their needs, ensuring smooth operations and long-term success.

Factors to Consider When Paying Your Virtual Assistant

Choosing the right approach to compensate your remote team is crucial for long-term success. The way you structure payments can impact efficiency, trust, and overall collaboration. At Armasourcing, we guide businesses in making informed decisions tailored to their needs.

Rate Structure: Hourly vs. Project-Based

Determining the right rate structure depends on the nature of the work. Hourly rates are ideal for tasks requiring flexibility, such as administrative support. Project-based rates work better for defined tasks like content creation or data entry.

We help businesses evaluate their assistant’s role and choose the best option. This ensures fairness and transparency, fostering a positive working relationship.

Managing Currency Exchange and Transaction Fees

When working with assistants in different countries, currency exchange and fees become key factors. Platforms like Wise and Payoneer offer competitive rates and low fees for international transfers. This reduces costs and ensures timely payments.

At Armasourcing, we assist businesses in navigating these complexities. Our expertise ensures that every transaction is secure, efficient, and cost-effective.

Payment Methods for Virtual Assistants: Choosing the Best Option

Efficient and secure systems are vital for managing transactions with remote teams. The right platform ensures smooth operations and builds trust between businesses and their assistants. At Armasourcing, we focus on helping you select the best tools for your needs.

Evaluating Security and Efficiency

Security is a top priority when choosing a platform. Leading systems like PayPal and Payoneer use advanced encryption to protect your money. These tools also offer fraud prevention features, ensuring every transaction is safe.

Efficiency is equally important. Platforms like Wise provide fast transfers, reducing delays. Automation features further streamline the process, saving you time and effort.

Matching Payment Methods to Business Needs

Every business has unique requirements. For example, if you work with assistants across borders, low fees and currency exchange options are crucial. Platforms like Payoneer and Wise excel in these areas.

At Armasourcing, we help you assess your needs and choose the right system. Whether it’s recurring tasks or one-time projects, we ensure your process is secure and efficient.

Comparing Popular Payment Platforms

Selecting the right platform for financial transactions can significantly impact your business’s efficiency and security. At Armasourcing, we help businesses evaluate the best options to meet their needs. Let’s explore the features of leading platforms like PayPal, Wise, Payoneer, and Skrill.

PayPal: Global Acceptance and Versatility

PayPal is a trusted name in the industry, supporting transactions in 200 countries and 25 currencies. Its global acceptance makes it a versatile choice for businesses working with assistants worldwide. The platform ensures secure transfers with advanced encryption and fraud prevention features.

PayPal’s mass payment option allows businesses to send money to up to 15,000 recipients at once. While fees range from 1.9% to 3.5%, the convenience and reliability often outweigh the costs. At Armasourcing, we recommend PayPal for its ease of use and widespread recognition.

Wise, Payoneer, and Skrill: Low Fees and Fast Transfers

Wise (formerly TransferWise) stands out for its low fees, typically less than 1% per transfer. It supports payments in 80 countries and over 50 currencies, making it ideal for international transactions. Wise’s batch payment feature allows up to 1,000 transfers at once, saving time and effort.

Payoneer operates in over 200 countries and supports 150 currencies. It charges a fixed fee of $3 per transaction, making it cost-effective for larger businesses. Skrill, another reliable option, offers competitive rates and fast transfers, ensuring assistants receive their earnings promptly.

At Armasourcing, we prioritize platforms that offer low fees and fast transfers. Whether you’re managing recurring tasks or one-time projects, these tools ensure smooth and secure transactions for your team.

How to Set Up a Streamlined Payment Process

Streamlining financial transactions with remote teams requires a clear and efficient process. By setting up the right system, businesses can save time, reduce errors, and maintain trust. At Armasourcing, we focus on creating solutions that simplify these steps for our clients.

Steps for Creating and Funding Your Payment Account

Start by selecting a reliable platform like PayPal or Wise. Register an account by providing the necessary details. Once registered, link your bank account to enable seamless transfers.

Funding your account is straightforward. Transfer money from your bank or use a credit card. Ensure you confirm all payment details to avoid delays. Platforms like Wise offer multi-currency accounts, making international transactions easier.

Automating Scheduled Transactions for Efficiency

Automation is a game-changer for managing recurring tasks. Set up scheduled transfers to ensure timely payments. This reduces the risk of human error and saves valuable time.

Platforms like PayPal and Payoneer allow you to automate payments. Simply configure the frequency and amount for each transaction. At Armasourcing, we integrate these features to streamline processes for our clients.

By adopting these strategies, businesses can maintain accurate records and boost productivity. Automation also enhances transparency, ensuring every transaction is tracked and secure.

Conclusion

Managing financial exchanges with remote teams demands precision and trust. Choosing the right tools ensures smooth operations and fosters strong business relationships. Platforms like PayPal and Wise offer secure and efficient solutions for handling transactions across borders.

At Armasourcing, we prioritize security and efficiency in every financial process. Whether you’re setting up an account or automating transfers, our solutions are designed to save time and reduce errors. We help businesses select the best rate structure and platform to meet their unique needs.

Trusted platforms lead to smoother transactions and better collaboration. If you’re ready to streamline your financial processes, consult with us at Armasourcing. We’re committed to providing reliable, secure, and efficient solutions for your business.

Source Links

- https://20four7va.com/virtual-staffing-101/vs-101-article-top-virtual-assistant-tools-101-part-6-payment-portals/ – VS 101 Article: Top Virtual Assistant Tools 101: Part 6 – Payment Portals

- https://www.virtualstaff.ph/blog/set-up-payment-system-for-virtual-assistant – How to Set Up a Payment System for Your Virtual Assistant | VirtualStaff.ph

- https://www.virtuallatinos.com/blog/accounts-payable-virtual-assistant/ – Accounts Payable Virtual Assistant: All You Need to Know | Virtual Latinos

- https://www.zirtual.com/blog/what-should-you-pay-virtual-assistants/ – Virtual Assistant Services Rates: What Should You Pay? | Zirtual

- https://www.linkedin.com/pulse/how-pay-virtual-assistants-from-philippines-2024-guide-slxsc – How to Pay Virtual Assistants from the Philippines: 2024 Guide

- https://beccamartini.medium.com/how-to-pay-virtual-assistant-from-the-philippines-recommended-payment-method-9e98f25fbe25 – How To Pay Virtual Assistant From The Philippines | Recommended Payment Method

- https://www.wishup.co/blog/best-ways-to-pay-virtual-assistant/ – How to Pay Your Virtual Assistant: 5 Popular Platforms

- https://www.linkedin.com/pulse/ultimate-guide-choosing-right-payment-method-virtual-assistants-up46c – The Ultimate Guide to Choosing the Right Payment Method for Virtual Assistants

- https://floowitalent.com/virtual-assistant-payment-essentials/ – Virtual Assistant Payment Essentials for Startup Owners – Floowi

- https://stealthagents.com/how-much-to-pay-a-virtual-assistant/ – How Much to Pay a Virtual Assistant | Ultimate Guide – Stealth Agents

- https://www.evirtualassistants.com/virtual-assistants/tips-on-how-to-pay-your-virtual-assistant-in-the-philippines/ – How To Pay Your Virtual Assistant | eVirtualAssistants

- https://hubstaff.com/blog/paypal-vs-payoneer-vs-transferwise/ – PayPal vs. Payoneer vs. Wise vs. Bitwage: A Comparison (2024)

- https://technologyadvice.com/blog/sales/stripe-vs-paypal/ – Stripe vs. Paypal: Which is Better?

- https://www.evirtualassistants.com/virtual-assistants/how-to-pay-my-remote-employees/ – How to Pay Remote Employees | eVirtualAssistants

- https://www.transfermate.com/post/virtual-accounts-and-virtual-wallets-a-complete-guide – Virtual Accounts and Virtual Wallets: A Complete Guide

- https://stripe.com/guides/payment-methods-guide – A Guide to Types of Payment Methods | Stripe

- https://www.avidxchange.com/glossary/virtual-payment-processing/ – Virtual Payment Processing

- https://www.intelusagency.com/blog/how-much-does-a-virtual-assistant-cost – How Much Does A Virtual Assistant Cost? | Blog

- https://www.zirtual.com/blog/virtual-assistant-cost/ – How Much Does a Virtual Assistant Cost? | Zirtual